Reports: WeWork to Delay IPO Amid Suspicion It Is Not Actually a Tech Company Worth $47 Billion https://t.co/CtPP9CVAm4 via @gizmodo

— lvl 45 CHAOS POTUS (@thetomzone) September 17, 2019

5 Ways to Spot a Unicorn Startup:

— Louis Winthorpe IV (@theskyisblack) September 17, 2019

a) MAGICAL accounting

1. IMAGINARY technology

iv.) LOSE at least $1 billion last year

{'5': HORNY execs who sexually harass employeeshttps://t.co/BkdEOUqAv6

Lmao ? “I suspect this obviously cash flow negative real-estate business is not a technology biz” good job journos ur killing it. ??♂️ https://t.co/yP4S06nkqT

— ?☀️? Flexitarian Gopi ????♂️? (@gopisangha) September 17, 2019

"Whatever the hell WeWork is—tech company or just a cult-like real estate company that happens to offer kombucha on tap and desperately wants to be viewed as a tech company—it may not be going public anytime soon."https://t.co/jURulNy4sn

— Amit Paranjape (@aparanjape) September 17, 2019

#notatechcompany #wework Reports: WeWork to Delay IPO Amid Suspicion It Is Not Actually a Tech Company Worth $47 Billion https://t.co/pteCgHKezp pic.twitter.com/lqMIS4vmoa

— SystHub (@systhub) September 17, 2019

If you’re a WeWork employee it’s time to head for the exits.

— Dare Obasanjo (@Carnage4Life) September 17, 2019

CEO who’s hidden the details of the business in S-1 filings so much he can’t get enough IPO interest at break even of funding raised has already cashed out $700M.

This is another MoviePass.https://t.co/w275NZQzvN pic.twitter.com/V3YPgdGb3K

The biggest backers of SoftBank Group Corp.’s gargantuan Vision Fund are reconsidering how much to commit to its next investment vehicle as an oversized bet on flexible workspace provider WeWork sours.https://t.co/1x0OrZ2LnF

— menaka doshi (@menakadoshi) September 17, 2019

We all know about tech unicorns — companies valued at $1 billion or more. A subset of them, however, aren't just that. They're something else. So obsessed with investor profit, they leave a societal rubble in their wake.

— Medium (@Medium) September 17, 2019

These are the daredevil unicorns. https://t.co/ZSwz3MqFCz

It is a blow for a company that had been one of the most richly valued of a raft of startups planning to go public in a banner year for IPOs, but has been dogged by doubt over whether it can thrive as a public company. https://t.co/CUF95tXqb7

— WSJ Mansion (@WSJRealEstate) September 17, 2019

It was not enough; WeWork has "postponed" its IPO. I reiterate that the founder has already cashed out to the tune of $700m and does not give a shit whether the company lives or dies any more, he and all his descendants are set for life: https://t.co/pYCBJ83xTK

— Laurie Voss (@seldo) September 17, 2019

WeWork owner The We Company said it expected to complete its IPO by the end of the year, after walking away from preparations to proceed with its stock market debut this month https://t.co/zKwpg6OXfC pic.twitter.com/20exGIPlI9

— Reuters Top News (@Reuters) September 17, 2019

IPO rejections like WeWork do not happen often. Also hard to see what will change before the end of the year to suddenly make investors excited. Will SoftBank now fund another round? Will it be enough cash? https://t.co/2TkTxGb6LQ

— Henry Blodget (@hblodget) September 17, 2019

The Saudi's are "re-investing Vision Fund I profits (~29% x $45B = $13B?) into Vision Fund II", and Abu Dhabi is putting in <$10B.

— Turner Novak (@TurnerNovak) September 16, 2019

This would put VF II at ~$130B (108 + 13 + <10)https://t.co/Qw0SgaLehy

A company named “We” makes for weird and confusing sentences in newspapers.

— The Rational Walk (@rationalwalk) September 17, 2019

“If the IPO doesn’t take place soon, We may have to look elsewhere for much-needed funding.”

The reporter means “We” the company.https://t.co/9GqFikbEGZ

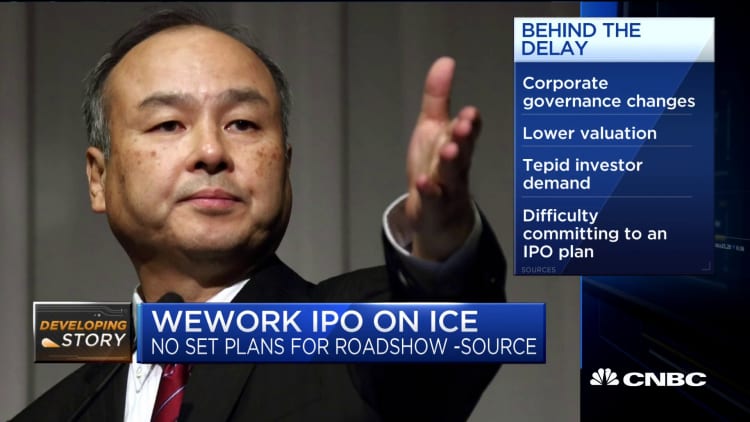

UPDATE: The We Company’s IPO is delayed, sources tell CNBC. https://t.co/gUl9uHI221

— CNBC Now (@CNBCnow) September 17, 2019

WeWork's on-again off-again IPO delayed again https://t.co/TCqhsl0HjA

— CNBC Tech (@CNBCtech) September 17, 2019

Check it. The We Company reportedly will put its public offering on hold https://t.co/BaedQ1gjZc via @techcrunch #tech #digital #data #business pic.twitter.com/E7LVsV832n

— Kohei Kurihara Blockchain CMO (@kuriharan) September 17, 2019

The We Company reportedly will put its public offering on hold#WeWork

— HighCrown (@HighCrownGroup) September 17, 2019

by #techcrunch

cc @WilliamSamedy @HighCrownGroup https://t.co/58QEx1utR7

Today in Wework update ---> Under pressure, The We Company now only says it expects to go public 'by the end of the year' https://t.co/STl2DXr3wh via @techcrunch

— Madhav Chanchani (@madhavchanchani) September 17, 2019

Just too much controversy thanks to @profgalloway ? but it’s better this way, go fix it Adam and come back with a stronger #WeWork https://t.co/i4YRBZt184

— Casey Lau (@casey_lau) September 16, 2019

The We Company reportedly will put its public offering on hold – TechCrunch https://t.co/w3XztVXuf1 pic.twitter.com/jJQkgzClBU

— Rich Tehrani (@rtehrani) September 17, 2019

Is it cos the investors realised that they're overpaying for an old idea that's just been tarted up with a hipster beard and a man bun?https://t.co/pp4JuujTjw

— Geordie Clarke (@GeordieClarke) September 17, 2019

Just in: WeWork has shelved its initial public offering after struggling to drum up investor interest in the multibillion-dollar listing https://t.co/fsoyrxlgD1 pic.twitter.com/TmK7z1X1LF

— Financial Times (@FinancialTimes) September 17, 2019

Here are FT stories today on three JPM-led deals where an ABL is contingent on a capital markets transaction:

— Robert Smith (@BondHack) September 17, 2019

1) WeWork postpones IPO https://t.co/OvVTGByF2L

2) Sirius pulls bond sale https://t.co/OYslFiry0a

3) Sanjeev Gupta struggles to sell HY bond https://t.co/rBS489uOBq

Employees at WeWork are waiting to hear just what went wrong with the IPO. They'll hear from executives tomorrow at 11am. But some are upset that they aren't getting a real town hall, just a webcast. Our story on the last minute dramatics at WeWork: https://t.co/WVLxxIwl6H

— Eric Platt (@EricGPlatt) September 17, 2019

In case you missed it: WeWork shelved its initial public offering on Monday night after struggling to drum up investor interest in the multibillion-dollar listing, in an embarrassing setback for the New York-based property group https://t.co/Wft2sObjHz

— Financial Times (@FinancialTimes) September 17, 2019

Softbank Group’s shares drop by >3% as WeWork postpones IPO after chilly response from investors. Company faced concerns over sway of chief executive Adam Neumann and operating losses. https://t.co/V3NtkKTwof pic.twitter.com/bCZkGATGIl

— Holger Zschaepitz (@Schuldensuehner) September 17, 2019

#WeWont I for one am shocked, shocked I tell you. | Just in: WeWork has shelved its initial public offering after struggling to drum up investor interest in the multibillion-dollar listing https://t.co/ybttb9z6yk

— Garreth Elston (@Africanadian) September 17, 2019

With the WeWork IPO postponed, there are now real questions internally of whether it can get off the ground this year or next, sources tells me. The financing package may need to be rewritten as well, which is only raising the stakes for WeWork https://t.co/WVLxxIwl6H

— Eric Platt (@EricGPlatt) September 17, 2019

The IPO is off for now https://t.co/aT8Ney7j7t

— BI Tech (@SAI) September 17, 2019

WeWork → WeBeWorkingLater. https://t.co/C81HdzMBhK

— Kontra (@counternotions) September 17, 2019

That noise you hear is the collective sigh of disappointment of millions of people who were looking forward to taking a short position. https://t.co/R8ackBHTHl

— Rohan Nair (@rohan10) September 17, 2019

Oh, who'd have thought that WeWork might actually be anything other than a massive loss-making Ponzi scheme?https://t.co/O2f6RXPzrz

— Russell Curtis (@russellcurtis) September 17, 2019

WeWork's parent company is reportedly delaying its idiotic IPO plans https://t.co/95GTbTu8es

— TNW (@thenextweb) September 17, 2019

.png)